The Advantages of ZINC DSCR Loans: A Smarter Alternative to Conventional Financing

Choosing the right financing option can have a significant impact on your financial success and the performance of your real estate investments. While conventional loans are often seen as a standard choice, they are not always the most effective option for investors.

ZINC DSCR loans provide unique advantages tailored specifically to the needs of real estate professionals, offering a smarter alternative to traditional banking. By prioritizing the potential of your investment over rigid personal financial metrics, ZINC empowers investors to achieve their goals with greater ease and efficiency.

Focus on Investment Potential, Not Just DTI

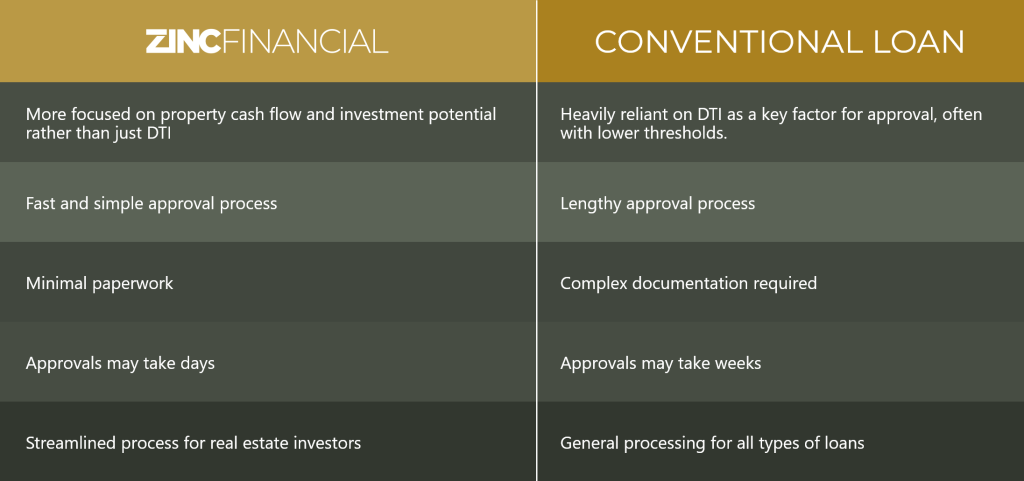

Conventional loans heavily rely on the Debt-to-Income (DTI) ratio for approval, often creating barriers for investors. This approach tends to prioritize individual financial circumstances, ignoring the broader potential of the investment itself. For instance, an investor with high personal debt but a high-performing property might be overlooked by traditional lenders.

In contrast, ZINC DSCR loans shift the focus to your property’s cash flow and overall investment potential. This model aligns with the mindset of seasoned investors who understand that real estate success hinges on the asset’s ability to generate income. Whether you’re managing a multifamily unit in a bustling urban area or a single-family rental in a growing suburb, DSCR loans provide the flexibility needed to capitalize on opportunities.

To illustrate, consider an investor looking to purchase a commercial property generating consistent rental income. With a conventional loan, their high personal expenses could disqualify them, despite the property’s profitability. A ZINC DSCR loan, however, evaluates the deal based on the cash flow it produces, enabling the investor to secure funding.

By emphasizing asset performance over personal financial ratios, ZINC offers unmatched flexibility for your financing needs, making it an ideal choice for those focused on maximizing their portfolio’s potential.

Flexible Terms That Fit Your Strategy

Traditional loans often come with rigid terms and limited options, making them unsuitable for dynamic investment strategies. In contrast, ZINC DSCR loans offer amounts up to $3 million, with diverse options like adjustable-rate mortgages (ARM), fixed-rate terms, and interest-only plans.

This versatility empowers you to customize your loan to your investment strategy. For example, if you plan to hold a property for the long term, a fixed-rate loan provides stability and predictable payments. On the other hand, if your strategy involves short-term flipping, an interest-only plan could minimize costs during the holding period, maximizing your ROI when the property sells.

Moreover, ZINC DSCR loans cater to investors with varying levels of experience. Whether you’re a seasoned professional managing a portfolio of properties or a newcomer making your first purchase, ZINC flexible terms ensure you have the tools to succeed. By accommodating unique strategies, ZINC DSCR loans help investors navigate market fluctuations and capitalize on emerging trends.

Streamlined Approval for Busy Investors

Navigating conventional loan approvals can be time-consuming, often requiring extensive paperwork and facing delays that can jeopardize deals. This process becomes particularly frustrating for investors working in competitive markets, where speed is crucial. ZINC DSCR loans simplify the process, providing faster approvals with minimal documentation.

For example, rather than requesting detailed personal income records and employment histories, ZINC focuses on the property’s ability to generate sufficient cash flow to cover loan payments. This streamlined approach not only saves time but also reduces the stress of compiling complex documentation.

Consider an investor who identifies a lucrative property at auction. In such scenarios, quick access to financing can make the difference between securing the deal and losing it to a competitor. ZINC efficient approval process ensures you can act decisively, turning opportunities into successful investments.

This efficiency ensures that you can seize investment opportunities without unnecessary holdups, making ZINC DSCR loans a reliable partner for ambitious investors.

Dedicated Customer Service and Quick Fund Access

One of the most common frustrations investors face with conventional lenders is the lack of personalized support. Long wait times, generic responses, and delayed funding can disrupt even the most well-planned projects. In contrast, ZINC DSCR loans prioritize quick access to funds and a customer-centric approach.

You’ll receive dedicated service from professionals who understand the unique demands of real estate investing. Whether you need guidance on structuring your loan or assistance navigating market-specific challenges, ZINC team is there to support you at every step.

For example, an investor purchasing a distressed property for renovation may require flexible funding arrangements to cover both the acquisition and repair costs. ZINC responsive team ensures that funds are disbursed promptly, allowing the project to proceed without interruptions. This reliability is particularly valuable in time-sensitive scenarios, where delays can result in significant financial losses.

By offering a seamless funding experience and unparalleled customer support, ZINC DSCR loans empower investors to achieve their goals with confidence.

Take the Next Step

Real estate investing is about seizing opportunities, adapting to market conditions, and maximizing returns. With ZINC DSCR loans, you gain access to financing solutions designed to meet the unique demands of your investments.

Whether you’re expanding your portfolio, renovating a property, or entering a new market, ZINC tailored loans provide the flexibility, speed, and support you need to succeed. Don’t let conventional financing hold you back—partner with ZINC Financial and unlock the full potential of your real estate ventures.

Fill out our form, and we’ll connect with you promptly to discuss your options.