Unemployment Rates in 2023

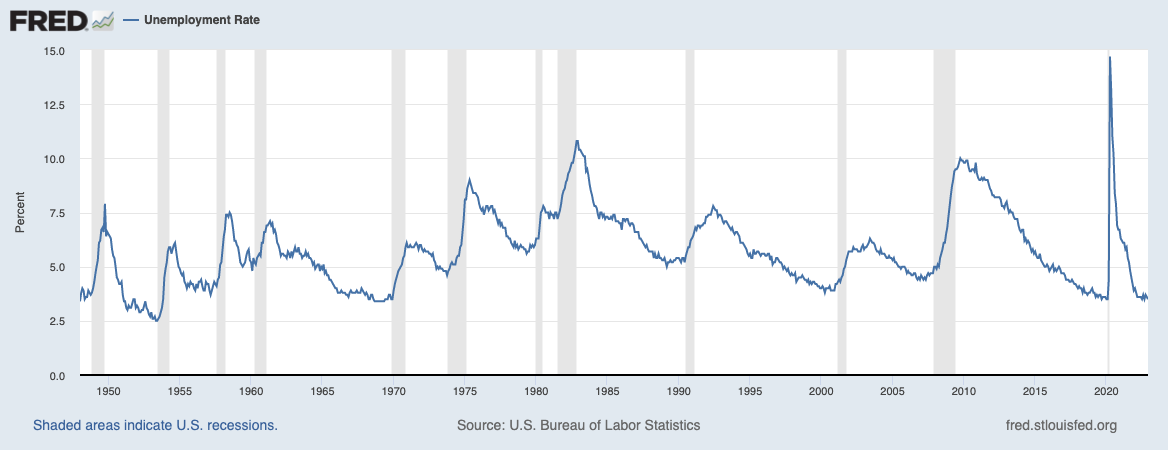

With unemployment rates at an all-time low, housing interest rates will begin to skyrocket to keep up with inflation and to battle a possible upcoming recession. Last December, the net job increase was about 220,000 – the lowest increase since 2020. With wage growth pressure clearly beginning to fall, we have a ways to go before we reach normalcy again. The unemployment rate in the United States is still at a nearly 50-year low; however, job growth is double where it should be for sustainability. This is due to the increase in people quitting their jobs which set the underemployment rate at a new low this month.

Connection to Housing Interest Rates

But what do these numbers mean for housing interest rates? Jerome Powell, the Federal Reserve chair, says that he supports a raise in interest rates at 25 basis points. He also said that he is “prepared to move more aggressively by raising the federal funds rate by more than 25 basis points” if inflation does not begin to decline later this year.

Predictions for This Year

However, although most experts are trying to avoid a recession, it seems that it is likely in the near future. We believe that the housing interest rates will definitely increase by 25bps by February this year, and we are even considering the possibility that they will increase to 50bps. It will depend on if the Federal Reserve can raise interest rates just high enough to combat inflation without further sending the economy on a downward spiral into recession.

Have questions about how this may affect you in the new year? Contact us today for more information.