The real estate market is a dynamic landscape, constantly influenced by economic shifts, demographic changes, and evolving consumer preferences. For investors, staying informed about current trends is crucial, particularly for those involved in private money lending. This blog post delves into the latest real estate market trends and explores how these trends are impacting the demand and benefits of private money loans.

Introduction

Private money lending, also known as hard money lending, has become an essential component of the real estate investment landscape. Unlike traditional loans, private money loans are funded by private investors or companies, offering faster approval times and greater flexibility. Understanding current market trends can help investors and lenders make informed decisions, optimize their strategies, and capitalize on opportunities.

Current Real Estate Market Trends

1. Increasing Home Prices

One of the most notable trends in the real estate market is the steady increase in home prices. Several factors contribute to this trend:

- Low Inventory: The supply of homes for sale has not kept pace with demand, creating a seller’s market.

- High Demand: The desire for homeownership remains strong, fueled by low mortgage rates and changing demographics.

- Inflation: Rising costs of construction materials and labor have also contributed to higher home prices.

Impact on Private Money Lending: As home prices rise, borrowers may seek private money loans to cover larger financing gaps, especially when traditional lenders impose stricter borrowing limits. Private money lenders can offer more significant loan amounts, enabling investors to secure properties in competitive markets.

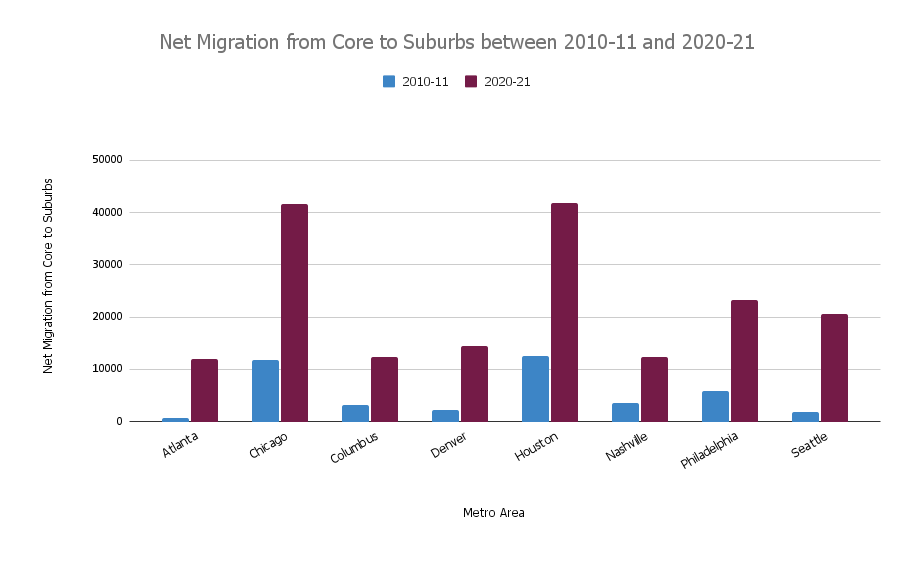

2. Shift Towards Suburban and Rural Areas

The COVID-19 pandemic has accelerated the shift from urban centers to suburban and rural areas. Remote work opportunities and the desire for more space have driven many buyers to seek homes outside of crowded cities.

- Remote Work: With many companies adopting flexible work arrangements, employees are no longer tethered to urban office locations.

- Lifestyle Changes: The pandemic has emphasized the importance of home space, driving demand for larger properties with outdoor areas.

Impact on Private Money Lending: This migration trend increases opportunities for private money lenders to finance properties in suburban and rural markets. These areas may offer higher returns on investment due to lower property prices and increased demand.

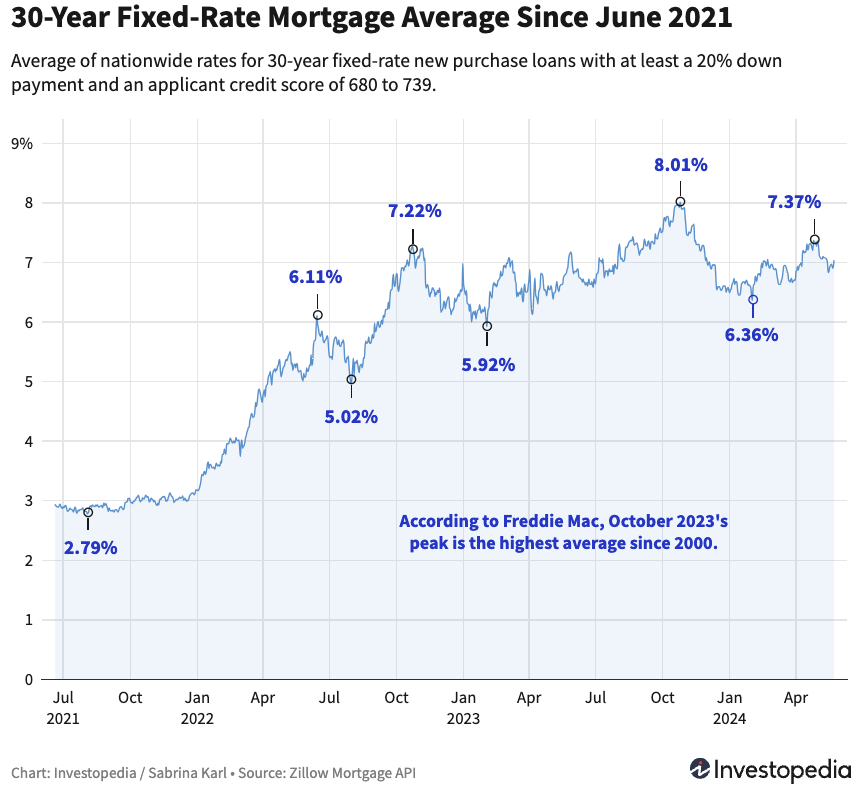

3. Rising Interest Rates

Interest rates have begun to rise after a period of historic lows. While still relatively low, the upward trend is expected to continue, impacting mortgage affordability.

- Federal Reserve Policies: The Federal Reserve’s policies and economic recovery efforts are influencing interest rates.

- Inflation Concerns: Rising inflation is prompting central banks to consider tightening monetary policy.

Impact on Private Money Lending: As traditional mortgage rates rise, private money loans become a more attractive option for borrowers needing quick financing or those unable to qualify for conventional loans. Private lenders can offer competitive rates and faster approval processes, making them a viable alternative.

4. Technological Advancements

Technology continues to transform the real estate industry, from virtual home tours to blockchain-based transactions.

- PropTech Innovations: Real estate technology (PropTech) is streamlining processes, improving transparency, and enhancing customer experiences.

- Blockchain and Smart Contracts: These technologies offer secure, efficient ways to handle real estate transactions, reducing the need for intermediaries.

Impact on Private Money Lending: Private lenders who embrace technological advancements can improve their lending processes, enhance due diligence, and provide better customer service. Technology can also facilitate faster underwriting and closing, making private money loans even more attractive.

5. Increased Focus on Sustainability

Sustainability has become a significant consideration in real estate, with more buyers and investors prioritizing eco-friendly and energy-efficient properties.

- Green Building Practices: There is a growing emphasis on sustainable construction methods and materials.

- Energy Efficiency: Homebuyers are seeking properties with lower energy consumption and environmental impact.

Impact on Private Money Lending: Private money lenders can target eco-conscious investors by offering loans for green projects and sustainable developments. Financing energy-efficient renovations or new green construction projects can attract a growing segment of environmentally aware borrowers.

Benefits of Private Money Loans in the Current Market

1. Speed and Flexibility

Private money loans offer quick approval and funding, often within days. This speed is crucial in a competitive market where opportunities can vanish quickly.

- Quick Approval: Unlike traditional loans, private money loans have streamlined approval processes, focusing more on the property’s value than the borrower’s credit score.

- Flexible Terms: Private lenders can tailor loan terms to fit the specific needs of the borrower, providing greater flexibility.

2. Easier Qualification

Private money loans are generally easier to qualify for, making them accessible to a broader range of borrowers.

- Credit Flexibility: Private lenders are more concerned with the value of the collateral than the borrower’s credit history.

- Asset-Based Lending: Loans are secured by real estate, reducing the risk for lenders and simplifying the qualification process.

3. Opportunity to Invest in High-Value Properties

With rising home prices, private money loans enable investors to pursue high-value properties that might be out of reach with traditional financing.

- Higher Loan Amounts: Private lenders can offer larger loan amounts, bridging the gap between the purchase price and available funds.

- Competitive Edge: Investors can make competitive offers quickly, gaining an edge in bidding wars.

4. Short-Term Financing Solutions

Private money loans are ideal for short-term financing needs, such as flipping houses or bridging loans.

- House Flipping: Investors can secure funds to purchase, renovate, and sell properties quickly.

- Bridge Loans: These loans provide temporary financing until long-term funding is secured, facilitating seamless transactions.

5. Financing for Unique Properties

Private money loans are well-suited for unique or non-traditional properties that might not meet the criteria of conventional lenders.

- Non-Standard Properties: Private lenders are more willing to finance properties that require extensive renovation or are outside typical lending parameters.

- Investment Opportunities: This flexibility allows investors to capitalize on unique opportunities that others might overlook.

Case Studies: Real-World Applications

Case Study 1: Suburban Expansion

Situation: An investor identifies a growing suburban area with significant development potential but faces stiff competition from other buyers.

Solution: The investor secures a private money loan, enabling a quick purchase and renovation of several properties. With private financing, the investor completes renovations ahead of schedule, selling the properties at a substantial profit.

Case Study 2: Rising Home Prices

Situation: A real estate investor wants to purchase a high-value property in a competitive market but lacks sufficient funds for a traditional mortgage.

Solution: The investor uses a private money loan to cover the financing gap, acquiring the property and benefiting from its appreciation. The speed and flexibility of the private loan allow the investor to act quickly and secure the deal.

Case Study 3: Eco-Friendly Development

Situation: An eco-conscious developer plans to build a sustainable housing project but struggles to obtain traditional financing due to the unconventional nature of the project.

Solution: A private money loan provides the necessary funds, allowing the developer to proceed with the green construction. The project attracts environmentally aware buyers, selling quickly and generating positive returns.

Expert Insights and Visual Analysis

Industry Expert Commentary

To provide a comprehensive view of the current trends and their impacts, we reached out to industry experts for their insights.

Jillian Hansen, Real Estate Analyst: “The current shift towards suburban and rural areas presents a unique opportunity for private money lenders. These markets are ripe for investment, and private financing can help investors capitalize on the growing demand.”

Todd Pigott, CEO and Founder of ZINC Financial, a Private Money Lender: “Rising home prices and interest rates are driving more borrowers towards private money loans. Our ability to offer quick and flexible financing solutions makes us a valuable resource for real estate investors in today’s market.”

Conclusion

The current real estate market trends present both challenges and opportunities for investors and private money lenders. By understanding these trends, private lenders can tailor their offerings to meet the evolving needs of borrowers, while investors can leverage private financing to secure high-value properties and capitalize on emerging market opportunities. The speed, flexibility, and accessibility of private money loans from lenders like ZINC Financial make them an invaluable tool in today’s dynamic real estate environment.

In summary, staying informed about market trends and adapting strategies accordingly is key to success in the real estate investment landscape. Private money lending continues to play a crucial role, providing the necessary financing to seize opportunities and drive growth in a competitive market.